FXIFY Challenge

Challenge is a proprietary trading program that offers traders an opportunity to demonstrate their skills in a controlled environment before gaining access to funded accounts. This challenge is structured to assess a trader’s ability to manage risk, meet profit targets, and demonstrate consistency in their trading strategy. FXIFY provides several variations of the challenge, each catering to different trader profiles and experience levels.

Challenge Structure

FXIFY offers several evaluation programs under the challenge, each designed to test different aspects of a trader’s abilities. The programs vary in duration, complexity, and the level of risk involved. Understanding these differences is essential for choosing the right challenge for your skill set and trading style.

1. One-Phase Evaluation

The One-Phase Evaluation is the simplest of the Challenge programs. It is designed for traders who prefer a straightforward path to funding. The goal is to reach a specified profit target within one phase, with strict adherence to risk management rules.

Key Features of the One-Phase Evaluation:

- Single Phase: Traders only need to meet a profit target in one evaluation phase.

- Shorter Duration: The program is typically completed in a shorter timeframe, allowing traders to quickly prove their abilities.

- Risk Management: Traders must maintain a safe trading balance and adhere to maximum drawdown limits during the challenge.

The One-Phase Evaluation is ideal for those who want to test their strategies quickly and have a direct path to receiving funding if they succeed.

2. Two-Phase Evaluation

The Two-Phase Evaluation adds a second stage to the challenge, providing a more comprehensive test of a trader’s skills. The first phase focuses on achieving a profit target, while the second phase requires traders to demonstrate consistency and discipline by meeting a second profit target.

Key Features of the Two-Phase Evaluation:

- Two Stages: Phase One focuses on reaching a profit target, while Phase Two tests consistency.

- Increased Difficulty: The second phase introduces additional challenges to assess a trader’s long-term success.

- More Time for Assessment: Traders are given more time to prove their skills, making it suitable for those who prefer a longer evaluation period.

The Two-Phase Evaluation is designed for traders who want to show their ability to perform well over an extended period and demonstrate consistency in their trading approach.

3. Three-Phase Evaluation

The Three-Phase Evaluation is the most comprehensive challenge, offering a rigorous assessment of a trader’s skills. Each phase builds upon the previous one, gradually increasing the difficulty level and the trader’s required performance.

Key Features of the Three-Phase Evaluation:

- Three Stages: Each phase increases in difficulty, providing a comprehensive assessment.

- Longer Duration: The three phases give traders more time to refine their strategies and improve their performance.

- Advanced Skill Development: This evaluation is ideal for more experienced traders who can demonstrate their ability to perform under different market conditions.

The Three-Phase Evaluation is designed for experienced traders who are looking to prove their advanced trading skills and demonstrate consistent performance over time.

4. Instant Funding

For traders who have already demonstrated their skills and trading competence, the Instant Funding program provides immediate access to capital. Traders do not need to go through an evaluation process, and they can begin trading with a funded account right away.

Key Features of the Instant Funding Program:

- No Evaluation: Traders can skip the evaluation phase and access funding directly.

- Immediate Capital: This program is ideal for traders who are confident in their strategies and want to start trading with live capital immediately.

- Proven Competence: Only traders who meet specific criteria or have a proven track record are eligible for Instant Funding.

The Instant Funding program is perfect for experienced traders who don’t need an evaluation but still want access to trading capital to increase their positions.

5. Lightning Challenge

The Lightning Challenge is a fast-paced, accelerated version of the Challenge. This program allows traders to complete their evaluation in a shorter timeframe, aiming for quick results.

Key Features of the Lightning Challenge:

- Fast-Paced Evaluation: The Lightning Challenge is designed for traders who can make quick decisions and work under pressure.

- Shorter Timeframe: This program offers a compressed evaluation period, allowing traders to demonstrate their ability in a more time-sensitive environment.

- Higher Intensity: The challenge is designed to simulate real-world trading conditions where traders must react quickly to market fluctuations.

The Lightning Challenge is suitable for traders looking to quickly prove their abilities and access funding in a shorter time frame.

Challenge Evaluation Criteria

No matter which challenge program a trader chooses, FXIFY uses specific criteria to assess their performance. These criteria ensure that traders can effectively manage risk while aiming for consistent profits.

Key Evaluation Criteria:

- Profit Target: Traders must achieve a specified profit target within the evaluation period. The target varies depending on the chosen program and difficulty level.

- Risk Management: Traders must follow strict risk management rules, including adhering to maximum drawdown limits and avoiding excessive losses.

- Trading Days: A minimum number of trading days is required to ensure that traders can demonstrate consistent performance over time.

- Leverage: FXIFY provides leverage options that traders can use to manage their trades. The use of leverage is carefully monitored to ensure it does not increase risk beyond acceptable levels.

These criteria are put in place to ensure that only traders who can consistently manage risk and achieve profits will pass the challenge and gain access to funded accounts.

Benefits of the challenges on FXIFY

Participating in the Challenge on FXIFY offers several key advantages for traders looking to scale their trading career:

Benefits Include:

- Access to Capital: Successful completion of the challenge grants traders access to funded accounts, allowing them to trade with FXIFY’s capital.

- Profit Sharing: Traders can earn a percentage of the profits they generate through their trades.

- Flexible Trading Options: FXIFY offers various account sizes and leverage options, allowing traders to tailor their accounts to their trading strategies.

- Educational Resources: Traders can access educational tools and resources to help improve their trading skills and increase their chances of success in the challenge.

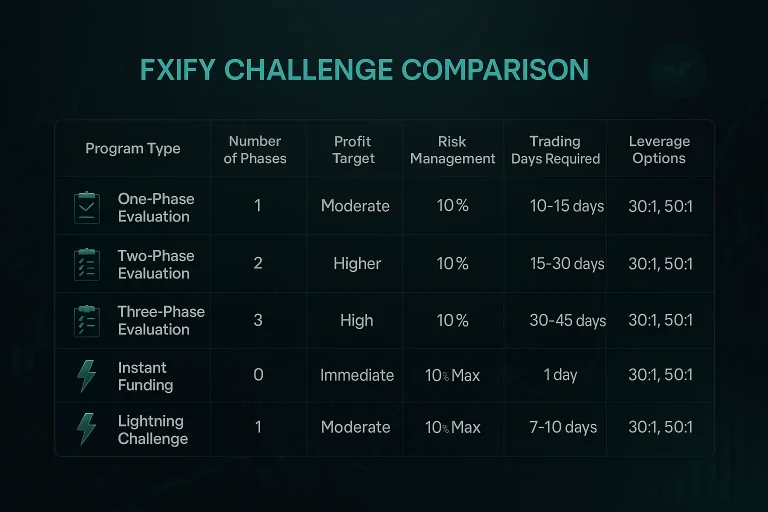

FXIFY Challenge Comparison

To better understand the differences between the various challenge programs, here is a comparison of the key features:

|

Program Type |

Number of Phases |

Profit Target |

Risk Management |

Trading Days Required |

Leverage Options |

|

One-Phase Evaluation |

1 |

Moderate |

10% Max Drawdown |

10-15 days |

30:1, 50:1 |

|

Two-Phase Evaluation |

2 |

Higher |

10% Max Drawdown |

15-30 days |

30:1, 50:1 |

|

Three-Phase Evaluation |

3 |

High |

10% Max Drawdown |

30-45 days |

30:1, 50:1 |

|

Instant Funding |

0 |

Immediate |

10% Max Drawdown |

1 day |

30:1, 50:1 |

|

Lightning Challenge |

1 |

Moderate |

10% Max Drawdown |

7-10 days |

30:1, 50:1 |

This table highlights the differences in program difficulty, profit targets, risk management rules, and trading duration. The choice of program will depend on a trader’s skill level, experience, and goals.

The FXIFY offers a structured and flexible path for traders to prove their skills and gain access to funded accounts. Whether you’re looking for a quick evaluation, a more extended test of your abilities, or immediate funding, FXIFY provides a range of options to suit different trading styles. By adhering to the evaluation criteria and demonstrating solid risk management, traders can increase their chances of success in the challenge and begin trading with the capital they need to scale their operations.

FAQ:

The Challenge on FXIFY is a series of trading evaluation programs that test traders’ abilities to meet profit targets and adhere to risk management rules. Successful traders gain access to funded accounts.

FXIFY offers five main programs: One-Phase Evaluation, Two-Phase Evaluation, Three-Phase Evaluation, Instant Funding, and the Lightning Challenge.

Profit targets vary depending on the program chosen. Traders must meet specific targets within the given timeframe.

Yes, all challenge programs include strict risk management rules, including maximum drawdown limits to ensure safe trading practices.

Yes, FXIFY provides leverage options of up to 50:1 for traders to use depending on the program selected.